Will a deeming rate change cost you?

We are calling for a continued freeze to deeming rates as interest rates fall.

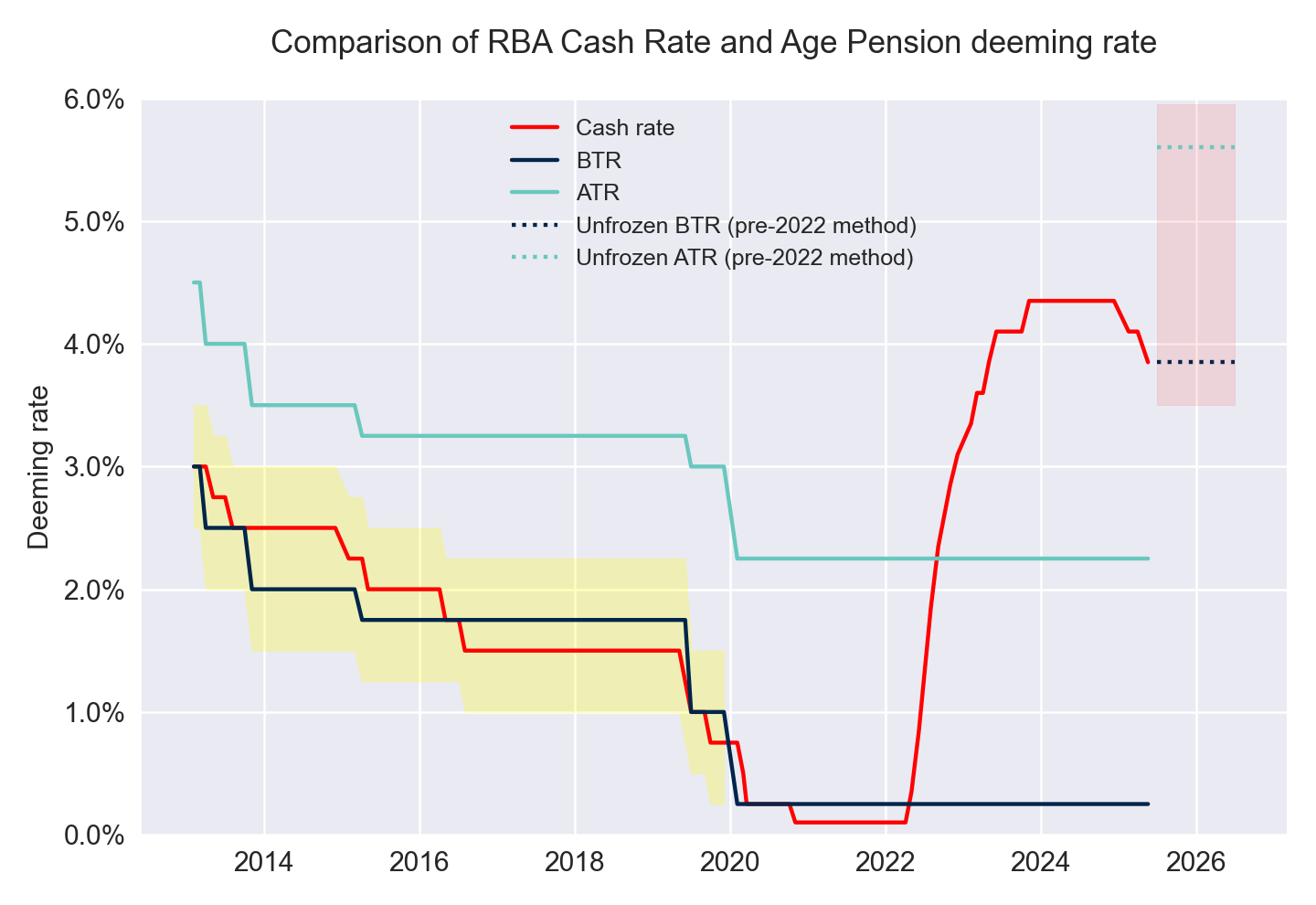

Deeming rates have been frozen since July 2022. The freeze has meant many full-rate and part-rate pensioners have maintained their income as the RBA cash rate has dramatically increased.

If the freeze ends and deeming rates change, pensioners (and other recipients of government support payments) could experience a substantial loss of income. It is unclear what the government will do from 1 July 2025.

Will Government continue the freeze or not?

Following the deeming rate freeze ending on 30 June 2025, the government has now announced that the deeming rates will increase by 0.50% from 20 September 2025. This will take the lower rate to 0.75% and the upper rate to 2.75%. You can read more about this announcement here.

The above are worst-case estimates of the potential impact based on the information available and assumptions made, including how future deeming rates will be set. The impact will vary depending on the full financial circumstances of specific individuals or couples. We discuss our assumptions further below.

You are now subscribed for updates on this campaign. Thank you for your support.

The amount of pension lost would vary depending on the method used to set deeming rates after 1 July and the specific financial situation of individuals/couples.

This will impact people receiving the full-rate Age Pension and those receiving a part-rate Age Pension (assessed under the income test), depending on the amount of deemed financial assets they hold.

Those supplementing their pension through paid work, Commonwealth Seniors Health Card holders, and anyone required to contribute to aged care costs could also be affected, depending on the amount of deemed financial assets they hold.

We have estimated the impact on Age Pension payments based on the current RBA Cash Rate by applying a similar method used before deeming rates were frozen.

Our estimates show the difference in fortnightly Age Pension received, based on the amount of deemed assets. This is a guide only and presents the greatest potential losses as our estimates assume all assets (apart from the family home) are financial assets and subject to deeming.

Further information on how much we estimate pensions to be impacted is provided below.

Given how integral the deeming rates are to the social security system, NSA is calling for a fair and transparent approach to how they are set. A consistent and transparent method for determining deeming rates will ensure Australians know the pension is fair and adequate and that arbitrary changes are not being made at the expense of pensioners’ living standards. You can read more about our advocacy on this topic here.

These are the assumptions used to produce these estimates:

- Unfrozen deeming rates increase in line with the higher RBA cash rate, applying a method similar to pre-2022.

- Based on assets only including a home and financial assets.

- Age Pension amounts do not account for future Age Pension indexation (next indexation is due in September 2025).

- The full income free area ($218 for singles, $380 for couples) is available to apply against deemed income.

- The income free areas, deeming rate thresholds, and other relevant amounts are based on the announced 1 July indexation.

Further details of the methodology are described below.

Q: Why are only some financial asset values shown?

A: We have selected the financial asset ranges most likely to be impacted by a change to the deeming rates. People with financial assets below this level are more likely to retain the full-rate pension; people above these levels are not likley affected becasue they are impacted by the Assets Test. As these are general estimates and not based on individual circumstances, we have calculated the amounts in $50,000 increments.

Q: Why are you only showing estimates for homeowners?

A: The above is intended as a broad estimate and not an individual calculation In order to simplify the options we have focused on the majority of pensioners affected who are homeowners. Inclusion of people receiving the Age Pension and renting would also involve other support payments.

Q: Why don't these estimates reflect what I'm receiving?

A: These estimates are intended as broad figures showing the potential worst-case impact of a change to deeming rates and are based on a number of assumptions.

Q: Are these estimates correct?

A: Our calculation estimates what deeming rates could be based on the current RBA Cash Rate if the freeze is lifted. It is a worst-case scenario if the method used prior to the freeze is applied, based on the relationship between the cash rate and deeming rates. Hopefully the government continues the freeze of deeming rates. But if the deeming rates freeze is lifted, government could determine how much they are increased. This would also be impacted by future RBA Cash Rate decisions. Additionally, we do not include any future indexation.

Q. Isn't it fair that deeming rates go back to "normal"?

A: The cash rate is unusually high and the freeze has meant pensioners have been shielded from losing pension at a time of higher living costs - which is good. While inflation is stabilising and interest rates are falling (slowly), cost-of-living pressures are still affecting households. If interest rates continue to fall as predicted, deeming rates will be lowered, meaning any budget gains for the federal government would be short lived. However, the political ramifications may not.

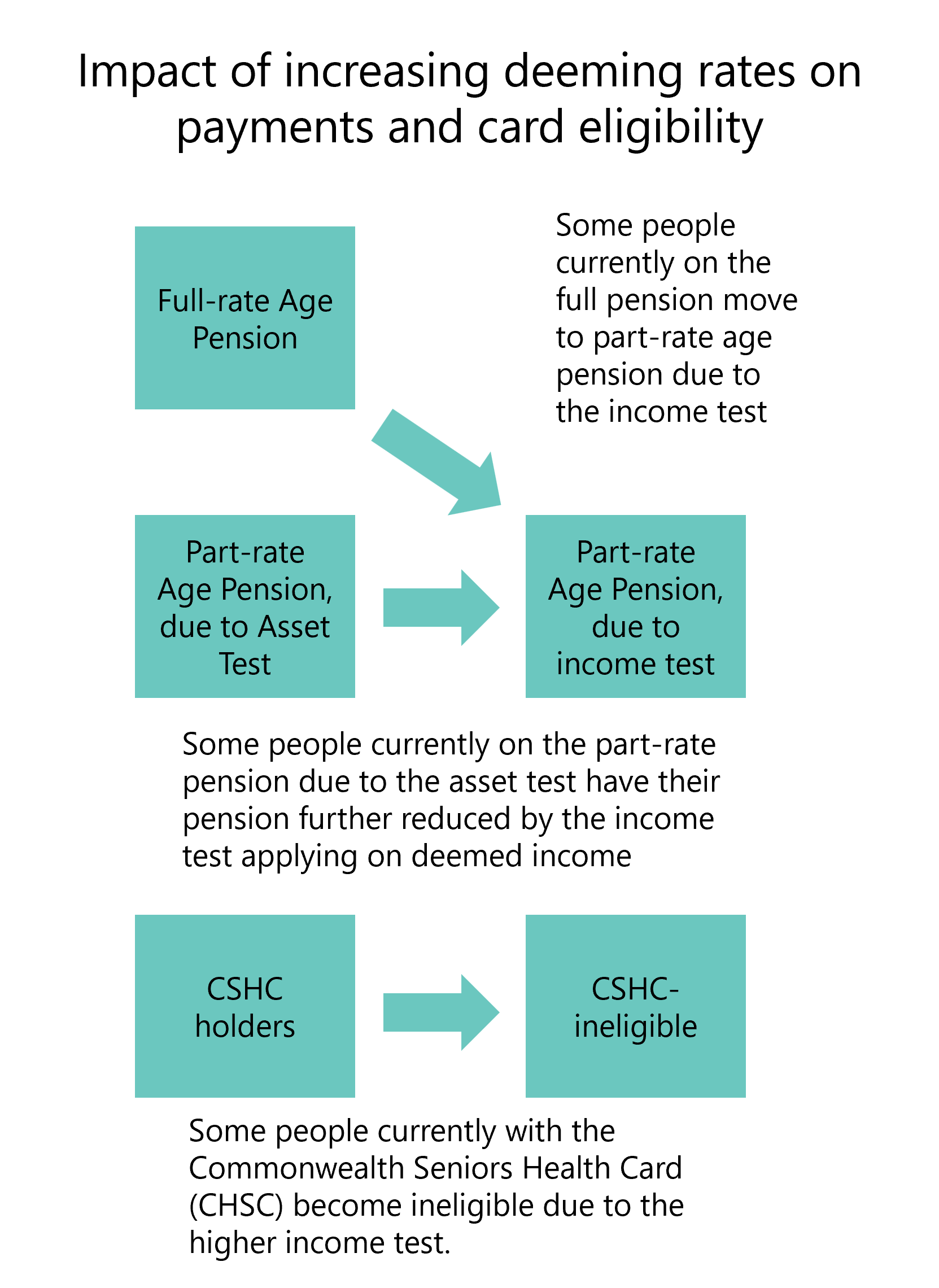

Deeming rates impact the amount of pension received under the Age Pension Income Test. This doesn't only impact part-pensioners, but it can also impact those receiving a full-rate Age Pension. Some people who currently hold a Commonwealth Seniors Health Card (CSHC) may lose this card if deeming rates increase. The higher the increase in the deeming rates, the more people who could be shifted onto a part-rate Age Pension, the more full and part-rate Age Pensioners will lose in fortnightly income and the higher number of people that will lose the CSHC.

We don’t know how many people will be impacted in each group, but the most recent figures have almost 1.8 million people on the full-rate Age Pension, over 382,000 on a part-rate Age Pension due to the Asset Test, over 463,000 on a part-rate Age Pension due to the income test, and almost 530,000 people holding a CSHC.

What are deeming rates?

For the Age Pension income test, it is not the actual income you earn from financial assets which matters, but the income you are estimated to have earned through a process called deeming.

Deeming only applies to financial assets, not all assets. Financial assets include things like superannuation (under certain circumstances), savings accounts, term deposits, some income streams or listed shares. More information can be found on the Services Australia website.

This process is intended to keep payments from frequently changing and provide an incentive to invest in higher yielding assets.

How are deeming rates set?

The deeming rates are set by the Federal Government and there is not a fixed calculation method publicly available. Services Australia says they "reflect expert advice about what the markets are doing".

However, since interest rates started increasing in 2022 the deeming rate has been frozen. If the deeming rates were to be unfrozen it would be up to the federal government to determine the new rates.

How much could a higher deeming rate reduce pensions?

The deeming rate doesn’t directly impact the amount of the Age Pension received. Instead, it changes the amount of income included in the income test, which can reduce the Age Pension received. However, even under different deeming rates people could still receive the full Age Pension, while others may still have their pension reduced by the Assets Test. It is best to talk to Services Australia about your individual Age Pension entitlement.

We have assumed that deemed income goes against the ‘income free area’ of $212 per fortnight for singles, and $372 for couples and there is no other income that might use up this concession, such as from work. Above this threshold, excluding the Work Bonus, the Age Pension is reduced by $0.50 per dollar or $0.25 each per dollar for couples. If the Asset Test results in a lower pension payment it is used instead.

How much higher might unfrozen deeming rates be?

Prior to the deeming rate freeze in 2022 (but after 2012), deeming rates followed a relatively consistent trajectory in line with RBA cash rate.

The ATR has generally between 1.5%-2.0% higher than the BTR rate, so for these calculations we are using a rate of 1.75% to estimate the difference between the ATR and BTR.

| Current rate (frozen) | Pre-2022 method | ||||

|---|---|---|---|---|---|

| Calculation method (with current Cash Rate of 3.85%) | N/A | BTR = Cash rate, ATR = BTR + 1.75% | |||

| BTR (Below Threshold Rate) applies to first $62,600 assets for singles, $103,800 for couples | 0.25% | 3.85% | |||

| ATR (Above Threshold Rate) applies to financial assets above $62,600 for singles, $103,800 for couples | 2.25% | 5.60% |

The below graph shows the recent history of the two deeming rates (BTR and ATR) compared to the RBA Cash Rate. Note the period highlighted in yellow reflecting where the BTR generally followed the Cash Rate, followed by the period when it has been frozen. The red highlighted section shows what the deeming rates could be based on this pre-2022 freeze method with the current cash rate.