Fair and consistent deeming rates

National Seniors Australia is calling for a fair and transparent approach to setting deeming rates.

Deeming is an integral part of the pension system.

It is used in the Age Pension means test and to calculate eligibility to the Commonwealth Seniors Health Card and aged care fees.

As part of the means test, deeming is used to estimate the amount of pension a person receives.

Deeming assumes financial assets earn a specific rate of income, regardless of their actual return.

According to the Department of Human Services, by treating all financial investments the same, deeming rules:

- encourage people to choose investments on their merit rather than on the effect the investment income may have on the person's pension entitlement

- provide an incentive to invest in higher return investments, as any interest rate achieved above the deeming rates doesn’t count as income

- create a simple way to assess income from financial assets, increasing predictability and reducing fluctuation in payments.

Deeming rates affect retirees when the income test, not the asset test, is used to set the pension.

Currently, 660,000 Age Pension recipients have their pension entitlement determined by the income test.

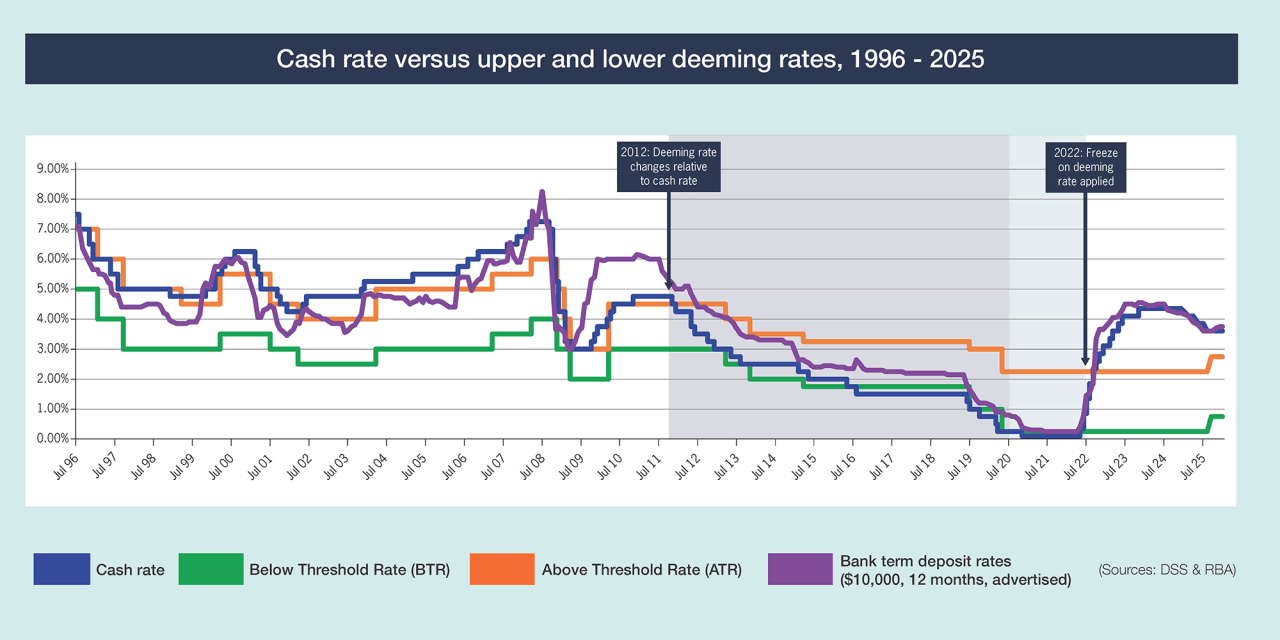

The decline in the Reserve Bank official interest rate from 2012 laid bare the deeming rate problem.

Between 1996 and 2011, changes in the deeming rates largely matched changes in official interest rates.

After 2011, something changed.

The deeming rates decoupled from changes in the cash rate, with negative impacts for pensioners. This is reflected in the graph below.

But since the election, things have flipped, thanks to a three-year freeze on any change to deeming rates and a rapidly rising cash rate.

Now, the upper deeming rate is below the RBA cash rate, back closer to where it was in the past.

The million dollar question is: What happens now that the freeze has been lifted?

The Federal Government has indicated this it will raise deeming rates when indexation is applied, as it did on 20 September 2025.

But it is unclear how far will they go with any future changes to deming rates.

Figure 1: Changes to the upper and lower deeming rates relative to the cash rate, 1996 – 2019

Sources: Department of Social Services; Reserve Bank of Australia

We are calling on the Federal Government to take a slow and steady approach to changing deeming rates since the freeze was lifted on 1 July 2025.

We also wants an independent approach to setting deeming rates linked to changes in the RBA cash rate to reflect that reflects the returns available to pensioners.

The lower deeming rate should reflect everyday savings accounts, not high return term deposits which lock away a pensioners money. Otherwise older people will be unfairly punished.

A consistent, transparent and fair method for determining deeming rates will ensure Australians know the pension is fair and adequate and that arbitrary changes are not being made at the expense of pensioners’ living standards.

Show your support by signing up to the campaign. With your help, we can make a difference.

You are now subscribed for updates on this campaign. Thank you for your support.