Media Release: Pension increase welcome, but reform needed

National Seniors Australia has welcomed the latest increase in the Age Pension, Carer Payment and Disability Support Pension rates.

National Seniors Australia has welcomed the latest increase in the Age Pension, Carer Payment and Disability Support Pension rates. From 20 March 2022:

- Age Pension, Carer Payment and Disability Support Pension rates will increase by:

- $20.10 a fortnight for singles to $987.60

- $30.20 a fortnight for couples (combined) to $1,488.80

- This is equivalent to $1.43 per day for singles and $2.15 per day for couples.

- Asset test limits have also been increased, to raise the threshold for eligibility for a part pension:

- a single homeowner asset test limit has increased by $6,750 to $599,750

- a homeowner couple asset test limit has increased by $10,000 to $901,500.

While the increase reflects rising inflation and growing cost of living pressures, there are many other reforms which are required to ensure the retirement income system is simpler and fairer.

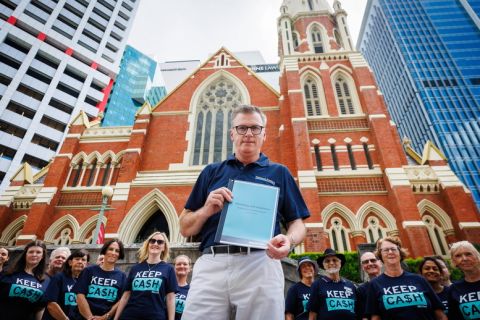

National Seniors Australia has outlined some of these reforms in its latest Federal Budget submission.

Independent Pension Tribunal

An Independent Pension Tribunal is needed to set the rate for the pension and pension supplements to stop it becoming a political football.

An Independent Tribunal would review and set the rates based on need to ensure pensioners facing cost of living pressure are not left behind.

According to National Seniors Australia Chief Advocate Ian Henschke, “There is a desperate need to particularly focus on Commonwealth Rent Assistance. Renters are the most likely to be living in pension poverty.”

Let Pensioners Work

National Seniors Australia is calling for the government to exempt work income from the income test. The income test unfairly punishes low-wealth pensioners who need to work to boost their income and savings.

Currently an aged pensioner starts to lose fifty cents in the dollar of their pension once they earn $240 or more a week and they pay income tax as well.

“In Australia, only 2.9 per cent of aged pensioners work compared to 24.8 per cent in New Zealand. Pensioners in New Zealand simply work and pay tax without being penalised with the loss of their pension payments,” Mr Henschke said.

“Changing the income test would not be a burden on the budget. Quite the opposite. It would boost GDP and government tax revenue. They would go from being seen as a liability to an asset.”

Downsizing exemption

Pension rules are trapping thousands of older Australians in larger, high maintenance homes or pushing them into residential aged care unnecessarily.

Many older Australians might downsize into something more suitable, but not when selling the family home results in a hit to their pension. But, if they go into residential aged care they get an exemption for two years.

“Allowing high level home care recipients to downsize their home without impacting their pension, will improve their mental and physical health, taking pressure off the residential aged care sector. It will also give them more money to spend and stimulate the economy.”