Bank branch closures spark Senate inquiry and regulator review

Banks are being asked to justify the impact on communities when they close branches.

Key points

Banks say preference for online banking is forcing closure of physical branches.

Senate inquiry examines closures in regional Australia.

Regulator forced to review how it monitors closure of branches and outlets.

Australia’s banks are under increasing pressure to justify their performance across a range of services following policy decisions affecting their everyday customers.

These include mortgage rate rises, not passing on interest rate rises to all depositors (the Australian Competition and Consumer Commission is now investigating this), and the closure of bank branches and outlets across the nation.

More than 80 branches have closed since September 2022, and the financial services watchdog, APRA, reports that between June 2017 and June 2022, 30% of bank branches closed across cities and regional and remote communities. There has been a consistent percentage drop across all states and territories.

The number of ATMs in major cities and regional areas has more than halved to 4,329 and EFTPOS terminals dropped from 800,000 to 700,000.

Community response to this has led to the establishment of a Senate inquiry into bank branch closures in regional areas – specifically the reasons for the closures and the impact on customers and communities.

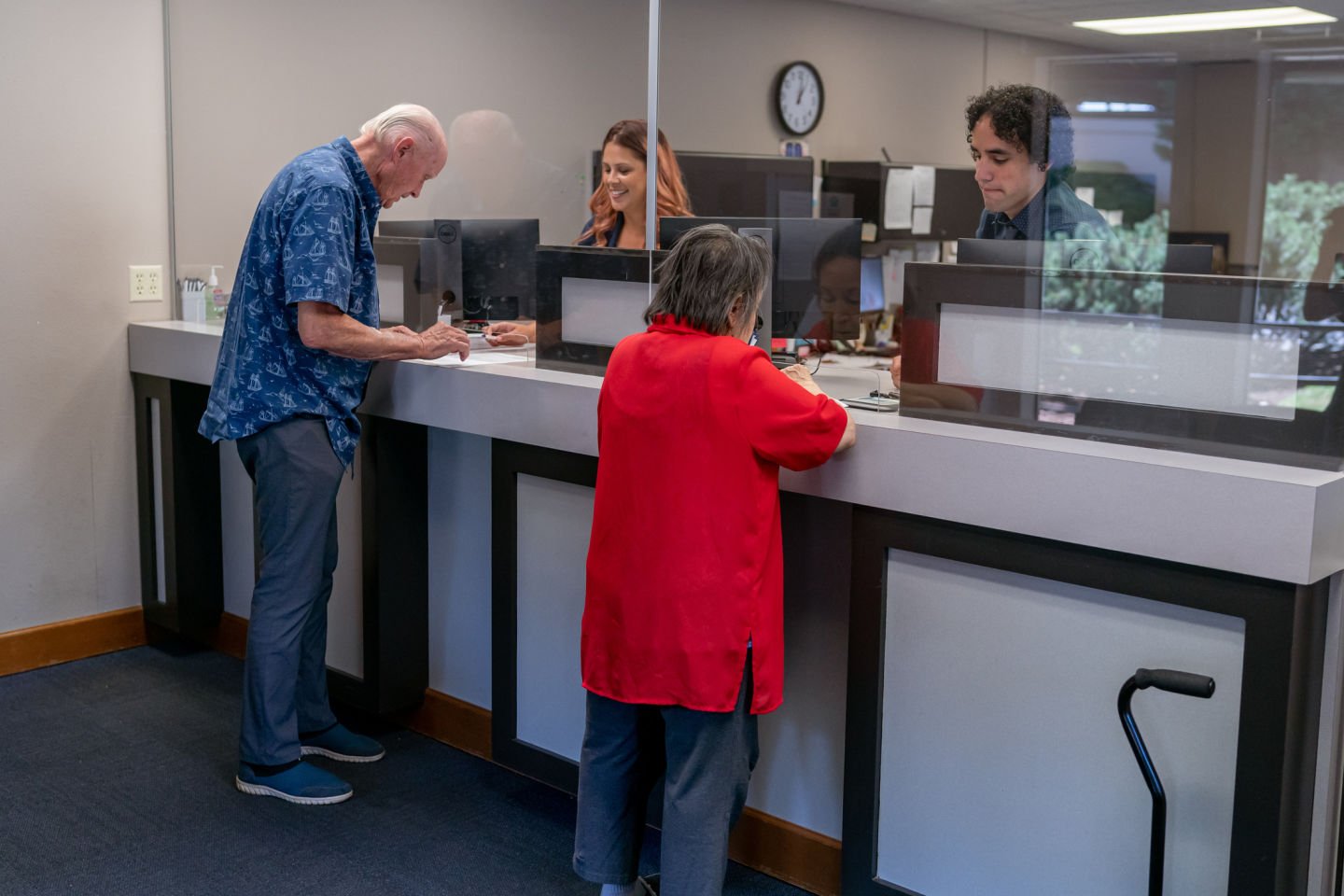

Older people and those living in regional communities, including small business operators, have been particularly affected by branch closures given the often-poor state of online technology and the big travel distances to the nearest town with an operational bank branch.

Some banks have responded to public opinion and the inquiry by pausing the spate of closures but continue to explain the strategy as a necessary business response as more customers favour online banking.

Australian Banking Association chief executive Anna Bligh said: “I’m not surprised that, for some people, it’s a pretty big and quite difficult change to adjust to.”

However, she said foot traffic inside bank branches had declined by almost 70% in recent years.

Ms Bligh said banks were taking resources out of “bricks and mortar” and funnelling them into digital services, because that’s what customers were using.

The ability of the Australian Prudential Regulation Authority (APRA) to accurately measure the state of the banking sector, including closures, has been questioned, forcing it to review its processes and role in providing transparency into the financial sector.

As part of APRA’s regulation of the financial sector it measures how many physical banking outlets there are, notes their locations, and counts ATMs and EFTPOS machines. In part, APRA’s review of its own information-gathering has been forced by the growth of banking apps, which currently fall outside its scope.

Now APRA is asking stakeholders, including bank consumer groups, what other services should be included.

A discussion paper with information about APRA’s consultation, including how to make a submission, is available here.

Further reading: APRA discussion paper, APRA statistics, Bank Closures Inquiry, ABC, AFR