The Age Pension - How it works and recent changes

Here's a quick rundown of what you need to know.

Although compulsory superannuation has been in place for nearly three decades, the Age Pension remains a vital source of retirement income for many older Australians. Keeping up-to-date with eligibility requirements, asset and income tests, and other changes can prove challenging (if not downright confusing). This article includes answers to commonly asked Age Pension questions, helpful resources and a summary of recent changes to the Age Pension. Plus, we take a look at National Seniors' efforts to advocate for a fairer retirement income system that supports the needs of all older Australians.

Make sure you stay informed by subscribing to the Connect and Money Matters eNewsletters.

In summary, you need to be:

- Of Age Pension age

- Below the income and assets test limits

- An Australian resident (normally for at least 10 years).

Your ‘Age Pension age’ depends on the year you were born. For example, if you were born between 1 January 1954 and 30 June 1955, your Age Pension age is currently 66.

For eligible applicants, Centrelink applies both the income test and assets test. The income test combines all your income sources, (including your deemed financial assets) to provide a fortnightly estimate. The assets tests are applied to all your assets, except the family home.

Generally, the more wealth you have the less pension you will receive. Your payment will be based on the test that calculates to the lowest pension.

There are two types of tests, as mentioned above – the income test and the assets test, which you can read about here.

It is far from a perfect system.

National Seniors hears from many older Australians who have been excluded from pension payments because the government estimates their income is higher than what bank term deposits are offering. This indicates an underlying issue with deeming rates, as well as the assets test.

For a sustainable retirement income system, changes need to be made. It's an issue we have highlighted for several years now. Read more here.

Increases to the Age Pension took place last month, with eligible couples receiving an extra $22.40 per fortnight and singles $14.80 per fortnight. Read more here.

The qualifying age for Age Pension increased to 66 years and 6 months on 1 July 2021. This is scheduled to increase to 67 in 2023.

You can also track your pension claim online and receive Centrelink messages electronically. Read about the changes here.

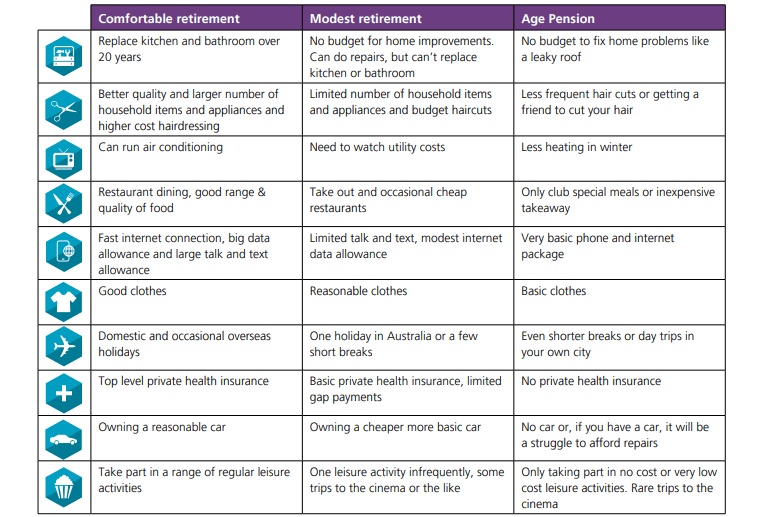

The Association of Superannuation Funds of Australia (ASFA) retirement standard provides a guide of what you will need to meet a ‘comfortable’ and ‘modest’ retirement.

Unfortunately, if you rely on the Age Pension as the sole source of retirement income, you are unlikely to meet either of the ASFA standards.

A comparison is provided below.

Source: ASFA

The following resources may prove useful:

- Age Pension: What you need to know

- Age Pension: How much you can get

- Tracking your pension claim online

- Setting up your Centrelink online account.

There is also support available for those wanting faster and easier access to their Age Pension entitlements, thanks to our partners, Retirement Essentials.

More than half a million people rely on the Age Pension as their sole source of income. With medical bills, grocery and energy prices, out-of-pocket health expenses, house and rental prices, and other concerns added to the mix, many older Australians find themselves living in poverty or extremely close to the poverty line.

Help National Seniors make a difference to the lives of older Australians (and future generations) by joining our Fix Pension Poverty campaign.

We are also fighting for fairer concessions and a fairer retirement income system that protects the interests of all older Australians. That includes those who rely on the Age Pension as their sole source of income, self-funded retirees, part-pensioners and the many Aussies transitioning to retirement.